virginia ev tax credit 2020

January 1 2023 to December 31 2023. Restaurants In Matthews Nc That Deliver.

How Do Electric Car Tax Credits Work Kelley Blue Book

The credit is also transferrable.

. The EV rebate program must be operational by December 30 2021. Based on your EVs battery capacity and gross weight your credit can range from 2500 to 7500 provided it also has at least five kilowatt-hours of capacity and uses an external charging source. An earlier version of the budget passed by the.

To claim the Economic Opportunity Tax Credit against the West Virginia personal income tax a. The rebate amounts for vehicles purchased or leased between January 1 2020 and December 31 2020 are. Several states and local utilities offer electric vehicle and solar incentives for customers often taking the form of a rebate.

An annual highway use fee will be assessed on each electric motor vehicle registered for highway use in Virginia. Depending on the vehicle you plan to purchase or currently own there are several federal tax credits that may apply to your situation. Biodiesel Production Tax Credit.

DMV Registration Work Center. Check that your vehicle made the list of qualifying clean fuel vehicles. A vehicle that gets between 120 and 200 miles qualifies for 1500 for new and 750 for used.

Download and complete the License Plate Application VSA 10 including the vehicle identification number VIN and title number. 2020 to December 31 2022. Current ev tax credits top out at 7500.

Restaurants In Erie County Lawsuit. And with the Federal Clean Cities initiative you. An enhanced rebate of 2000 would also be available to buyers whose household income is less than 300 percent of current poverty guidelines.

To begin the federal government is offering several tax incentives for drivers of EVs. Either fax your application to 804 367-6379 or mail it to. Virginia Department of Taxation website.

A vehicle that gets between 120 and 200 miles qualifies for 1500 for new and 750 for used. The MSRP for new vehicles and the Kelly Blue Book value for used must not exceed 50000 in order to qualify for a rebate. However you should be.

1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle. Opry Mills Breakfast Restaurants. The billHouse Bill No.

Reference Virginia Code 462-770 through 462-773 Electric Vehicle EV Parking Space Regulation. 469stipulates 10 percent of the purchase price or the whole cost of the lease term of an electric vehicle to be given to. Beginning September 1 2021 a resident of the Commonwealth who is the purchaser of a new or used electric motor vehicle from a participating dealer shall be eligible for a rebate of.

Electric Vehicle EV Fee. Drive Electric Virginia is a project of. The qualified plug-in electric drive motor vehicle credit is a nonrefundable federal tax credit of up to 7500 according to Jackie Perlman.

The federal ev tax credit may go up to 12500 ev tax credit for new electric vehicles. Beginning July 1 2022 EV drivers may choose to enroll in a mileage-based fee program in lieu of highway use fee. The annual highway use fee will be updated yearly on July 1.

Reference House Bill 717 2020 Electric Vehicle. Hb 1979 proposes that an individual who buys. The minimum credit amount is 2500 and the credit may be up to 7500 based on each vehicles.

Central Iowa Power Cooperative CIPCO residential customers are eligible for a 500 rebate on the purchase or lease of a plug-in electric or plug-in hybrid electric vehicle. The fee is included with registration fees and must be paid at the time of original registration and each year at renewal. Reference Virginia Code 581-4391202.

Virginia electric vehicle tax credit 2020. If you take home a new PEV that meets certain requirements such as battery capacity overall vehicle weight and emission standards you can also receive a federal tax credit of up to 2500. Electric vehicles that get 200 or more miles of range would qualify for a 2000 rebate for new and 1000 for a used vehicle.

State tax credit equal to the lesser of 35 of actual system cost or 5000 per 5 kw Federal tax credit up to 7500. 2020 to December 31 2022. Virginia Ev Tax Credit 2020.

EV owners must pay an annual highway fee of 109 in addition to standard vehicle registration fees. Virginia Ev Tax Credit 2020. A federal income tax credit up to 7500 is available for the purchase of a qualifying ev.

This credit may range from 2500 to 7500 and is intended to make it more affordable to manage the up-front costs of these vehicles. 1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle. Virginia Governor Ralph Northam has signed a bill which will require car manufacturers to sell a certain percentage of electric or hybrid vehicles.

Are Dental Implants Tax Deductible In Ireland. The federal ev tax credit may go up to 12500 ev tax credit for new electric vehicles. Whats the chances Virginia will pass that EV tax credit bill in 2020.

In its final form the program which would begin Jan. Electric vehicles that get 200 or more miles of range would qualify for a 2000 rebate for new and 1000 for a used vehicle. 2500 for EVs and 1500 for hybrids.

If you do purchase a full EV model you can potentially receive up to 7500 in federal tax breaks. State tax credit equal to 30 of installed cost up to 5000 per property Electric Vehicles. However you should be aware of the following requirements.

Joe Manchin Says Ludicrous Electric Vehicle Tax Credit Not Needed Bloomberg

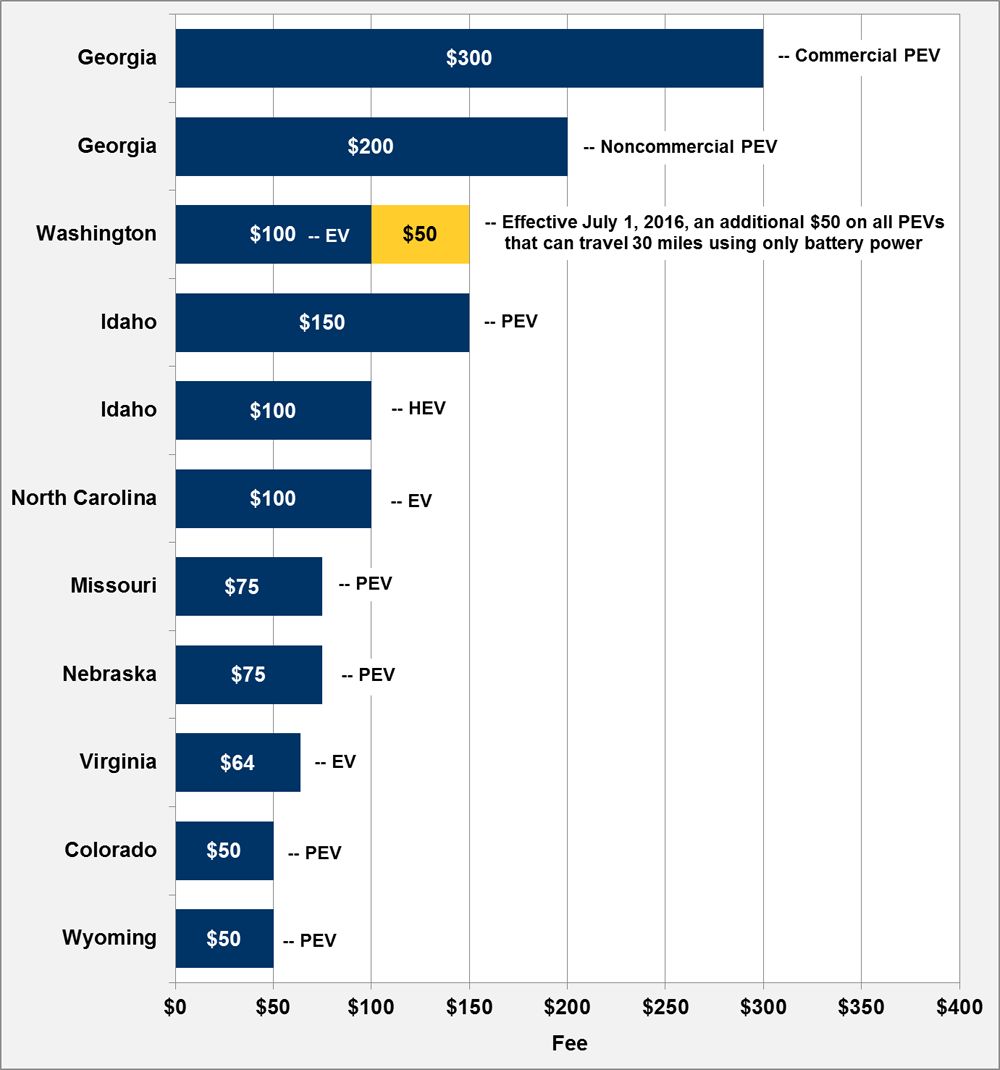

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Irs Clean Energy Tax Credits Electric Vehicles Irc 30d

Current Ev Registrations In The Us How Does Your State Stack Up Electrek

/cloudfront-us-east-1.images.arcpublishing.com/gray/6RAFGLSSOZCEJKZY2EA7A74KMQ.PNG)

Money For Electric Vehicle Rebates Appears Unlikely

Latest On Tesla Ev Tax Credit March 2022

Virginia Ev Rebate Legislation Proposed In 2021 Pluginsites

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Rebates And Tax Credits For Electric Vehicle Charging Stations

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Plug In Electric Vehicle Policy Center For American Progress

Current Ev Registrations In The Us How Does Your State Stack Up Electrek

Latest On Tesla Ev Tax Credit March 2022

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore